Every citizen of America on the age of 18 likely has a credit credit rating. Your credit credit score is a compilation of your bank card use and bill- . These records are personal, by providing them your SSN, however you can share them with the others.

History

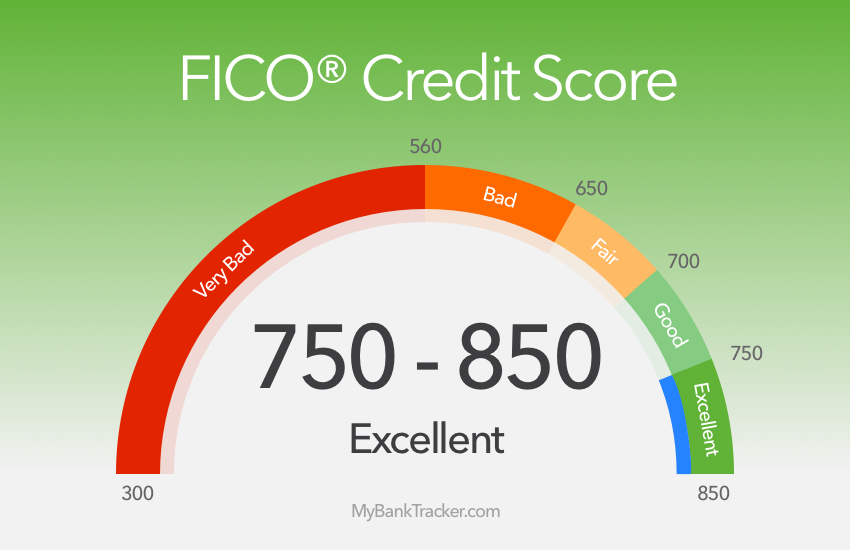

“FI-CO” means the Fair Isaac Corporation, which in 1970 devised the formula for discovering someone else’s FICO or credit rating. Banking, insurers, property services, mortgage brokers and a number of other kinds of businesses make use of an individual ‘s credit score to learn how liable she’s with cash. The rating ranges from 200 to 800. You will want a rating of at least 650 to let a flat also to get advantageous rates of interest on loans.

Process

You must supply your SSN, when you complete a rental program. You need to sign your name and give the landlord or service authorization to to perform your credit credit score. If permission is not given by you, the landlord or service might not pull the credit file. Needless to say, in the event that you will not submit your SSN, landlord or the service is not going to let you an apartment.

Function

Your credit credit score wills operate utilizing the three primary credit reporting agencies: Equifax, Experian and Trans Union. You will charge for these reviews. The landlord can examine your credit credit score and view the credit rating to find out if he desires to lease you an apartment. For those who are in possession of a poor credit rating, he might elect to reject you. This is the reason a lot of people that have credit scores that are lousy can’t get flat leases.

Advice

You could increase your credit rating a couple of ways that are various. On a monthly basis, one manner would be to pay your entire accounts promptly. Another manner would be to pay any out standing invoices or accounts in groups off. Additionally, restrict the amount of credit inquiries; tend not to let your credit rating is accessed by multiple companies, or your rating may possibly decrease somewhat. Keep bank card accounts use and open them every month with utilizing credit showing your duty.

Pro Insight

When you yourself are in possession of a poor credit rating, you could possibly have trouble not only leasing a flat, but also receiving mobile phone account, banking account, a charge card and also work. The FI-CO rating is an essential attribute of your fiscal well-being. You may try speaking to the landlord about your circumstances in case your application was dropped. He might just determine to give an opportunity to you or request that you put down a bigger deposit.